Bonds have been around for thousands of years, dating back to as far as 2400 BC. Throughout the centuries, the use of bonds has grown exponentially, with both governments and companies using these securities for crucial funding. In this piece, we take a brief, but important, look at the history of bond investing, focusing in on the U.S. bond market.

The First Bond Ever… Circa 2400 B.C.

The first recorded bond in history dates back to 2400 B.C. – a stone discovered at Nippur, in Mesopotamia, now present-day Iraq.

This particular bond guaranteed the payment of grain by the principal and the surety bond guaranteed reimbursement if the principal failed to make payment. Corn was the currency of that time period.

Fast Forward: Venetians Create Advanced Bond Markets

During the 1100s, Venice began issuing government bonds to fund its wars, known as the presiti. The city continued to evolve its bond market throughout the 14th century, when denizens of Venice could purchase and trade government securities, which paid the owner an endless annuity at a set rate.

The First Official Government Bond

The first ever government bond was issued by the Bank of England in 1693 to raise money to fund a war against France. These first bonds were a mix of both lottery and annuity.

The First Official U.S. Government Bond

An obvious trend appears across the globe, with more and more countries following England’s lead and issuing government bonds to fund wars. In the U.S., the case was no different.

The first U.S. government bond begins with the Revolutionary War, when the country issued its first bonds to raise money to fight the war. The Treasury offered loan certificates, the equivalent of bonds. In that year, private individuals bought more than $27 million in bonds to finance the war.

The First U.S. Treasury Bond

The first U.S. Treasury bonds, which were initially called “Liberty Bonds,” were issued to fund World War I. In 1917, the First Liberty Loan Act authorized the issue of $5 billion worth of bonds at 3.5 percent interest three weeks after the United States declared war on Germany.

Treasuries Become Safe Haven During the Great Depression

Long-term government bonds proved to be a safe haven from the stock market collapse in 1929, a year in which they returned 3.4%. Following the crash and the resulting depression, U.S. bonds logged in impressive returns.

Bond Holders Hit During Eisenhower Recession

During the “Eisenhower Recession,” which was from 1955-1959, long-term government bond investors lost money four of the five years.

During this time frame, rates were steadily rising, putting pressure on government bonds.

Vietnam, Rampant Inflation, and Rising Interest Rates

In 1969, the U.S. economy was plagued with rampant inflation and rising interest, while at the same time the U.S. became involved in the Vietnam War. Long-term bonds were hit worst, losing almost a quarter of their value that year.

High Yield Bonds Introduced to the Public; Explosive Growth Follows

During the late 1970s and through the ’80s, non-investment grade public companies were allowed to issue corporate debt; this followed after bonds suffered deep losses following two oil shocks, rampant inflation, and rapidly rising rates.

Up until this point, only investment grade corporations were allowed to issue public bonds, but if a company’s rating happened to fall after the bond was issued, these were still allowed to trade and were called “fallen angels.”

In 1977, however, Bear Stearns underwrote the first new-issue junk bond in decades. By 1983, more than one-third of all corporate debt was non-investment grade. By 1989, the junk-bond market grew to $189 billion.

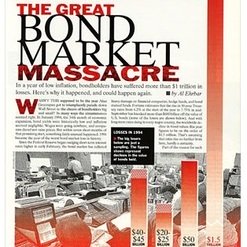

The Great Bond Massacre

In 1994, the unexpected rise in the Federal Reserve’s short-term rate sparked a massive selloff in bonds, which was exacerbated by the use of derivatives and leverage.

Fortune Magazine estimated that $1 trillion in bond assets were lost.

The Rise of Derivatives

Though one of the first derivatives of debt came in the ’80s, with the creation of collateralized debt obligations, these products remained fairly obscure until after 2000. Soon enough, CDOs became more popular, more complex and exponentially riskier, even though these securities often held high credit ratings.

From 2000 to 2007, worldwide fixed income exposure doubled in size; responding to increased demands for bond-like securities, Wall Street continued to pump out new derivatives, like mortgage-backed securities.

The Crash

After the housing bubble burst, fixed income financial derivatives like CDOs and MBS’s took a tremendous hit. Owners of these derivatives were suddenly bleeding money, and stuck with toxic assets no one would touch. Alongside non-investment grade bond markets, equity markets also tumbled, forcing U.S. regulators and the Federal Reserve to step in and try to stop the financial crisis.

QE 1, 2, 3…

For the first time in U.S. history, the Federal Reserve rolled out not one, but three unprecedented stimulus packages.

Throughout these three major policy moves, the Fed pumped trillions of dollars into the markets by purchasing Treasuries and mortgage-backed securities. At the same time, the Fed continuously slashed interest rates until it could no longer lower the near-zero rate.

Taper

On December 18, 2013, the Federal Reserve announced that it would begin tapering its bond-buying program. The Fed announced that the taper will be completed by October of 2014 (all else equal, of course), marking the end of three rounds of quantitative easing.

The Bottom Line

While we’ve only briefly covered some of the most notable events in the history of U.S. bond investing, it is important for investors to be aware of how exactly bonds have reacted in the past to economic headwinds, including rising interest rates, inflation, and the use of derivatives.