When it comes to investing in bonds, there are a variety of flavors. From staid U.S. Treasuries to more exotic I.O.U.s, the bond market is filled with unique ways to get your fixed-income fix. The unfortunate thing is that most investors strictly focus on Treasuries and bread-n-butter investment grade corporate bonds. More and more, that focus has come from owning mutual funds and ETFs that are tied to the Barclays Capital Aggregate Bond Index.

While there is nothing wrong with that, you can do better and you don’t have settle with being average. Some of these more exotic bonds are available to regular retail investors and could make interesting additions to your fixed income portfolio. So what kind of bonds outside the norm are accessible?

Be sure to read the 25 Terms Every Bond Investor to Know as you further investigate the fixed income space.

Here is BondFunds.com’s guide to some of these weird bonds and the funds that own them.

Fallen Angel Bonds

Just like you or me, companies have credit scores. And just like with individuals, those scores can rise and fall based on a variety of factors. Everything from deteriorating business trends and lower cash flows to rising debt amounts and a weakening of balance sheets can change their credit rating and result in a downgrade.

When that happens, a firm’s already issued bonds will generally fall in price as investors demand a higher yield for the new risks associated with holding that bond. Fallen Angels are the name for bonds that were once investment grade, but have been downgraded towards junk status. The line between investment grade and junk/high yield status is ‘BBB’ for ratings agency Standard & Poor’s.

Typically, firms that have run into trouble and have seen their debt rating fall still have better credit prospects and debt repayment abilities than firms that are originally in the junk tier of the bond market. For investors, it can be an opportunity to pick up some extra yield without adding that much more risk.

While bond funds that own a wide variety of high yield debt will include some Fallen Angel bonds, the Market Vectors Fallen Angel HY Bond ETF (NYSEArca: ANGL) is the only fund that tracks these former investment grade bonds exclusively. The ETF tracks 150 different bonds and can be expected to have a yield above that of investment grade corporate bond funds.

Crossover Bonds

Willing to forgo a little yield, but get a tad bit more security from your bond as well as the potential for some capital appreciation? Then crossover bonds could be for you. Unlike Fallen Angels—which have made the plunge into junk status—crossover bonds are still straddling the fence. Either just on the cusp of investment grade or high yield, crossovers fall within the credit ratings scale of BBB+ to BB-.

This grey area does have some advantages for investors. Usually, investment grade bonds are associated with lower yields, while junk is bracketed to higher yields. Crossovers allow investors to still have the quality associated with investment grade, while gaining a few extra points of yield. Additionally, crossovers have the potential for capital appreciation.

Many institutional investors—such as pension funds, insurance companies, endowments—characteristically state in their mandates that they can only own investment grade bonds. So if a crossover bond is downgraded, many of these investors are forced to sell their holdings of these bonds. That causes the prices of crossovers to fall more than you would expect as the institutions dump their holdings. Most of the time, other opportunistic investors—hedge funds, mutual funds etc.—will come in and snag these bonds, causing a rise in prices. An upgrade will result in similar actions, but in reverse.

Be sure to also read the Brief History of Bond Defaults.

Currently, the SPDR BofA Merrill Lynch Crossover Corporate Bond ETF (NYSEArca: XOVR) is the only fund that specifically targets these kinds of bonds.

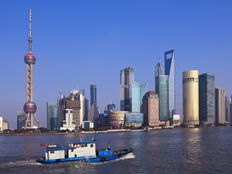

Dim Sum Bonds

Eating Dim Sum can be a treat for your stomach, and investing in Dim Sum can be a treat for your portfolio. As China has grown into a global superpower, the nation has undergone a huge liberalization with regards to its financial markets and capital controls. One of the biggest changes has been allowing foreign investors the ability to directly invest in its bond markets.

Dim Sum Bonds are those denominated in Chinese yuan or renminbi—the national currency—and issued in Hong Kong. The vast bulk of these have been issued by Chinese firms or firms located in Hong Kong. However, several international firms—like McDonalds and Caterpillar—have recently started tapping the Dim Sum market for raising capital.

While yields for Dim Sum bonds are relatively low, investing in the bond type does have some benefits for investors. China’s capital controls prevent international investors from directly investing in domestic Chinese debt. By using Dim Sum bonds—because they are issued in Hong Kong—investors can gain access to many of the same companies that have been traditionally off-limits. Secondly, unlike many currencies, the yuan doesn’t float freely, as it’s managed by the government. However, that is beginning to change and analysts predict that the currency is vastly undervalued on the global marketplace. That will lead to some pretty big price jumps for these bonds.

There are several options—like the HSBC RMB Fixed Income Fund (HRMBX) and PowerShares Chinese Yuan Dim Sum Bond ETF (NYSEArca: DSUM )—for investors to choose from.

Convertible Bonds

Do you enjoy the potential upside of the stock market, but want some of the protection that bonds can give? Convertible bonds, or converts as they are typically called, are a great way to play both sides of the coin.

Like traditional bread-and-butter bonds, converts have face values, coupon payments and maturity dates. However, convertible bonds have a special feature: they can be exchanged for a specific number of shares of the issuer’s common stock at a later date. This generally happens when the price of the firm’s shares hit a certain predetermined amount. This provides investors the potential to play both a company’s debt and equity via a single security.

Now, many factors affect the price of convertible bonds. This includes the current interest rate climate, which affects the bond side, as well as supply/demand for the underlying firm’s shares, which affects the stock side. Add in the conversion covenants associated with the bonds and we can see why converts usually don’t make it to the average retail investor’s portfolio.

That’s a shame because the dual nature of the bonds makes them an amazing total return element for a portfolio.

Buying convertible bonds is still a relatively tough nut to crack. The size of the market is still quite small and rising investor interest over the last few years has caused many of the funds that dabble in this sub-sector of the bond market to close. With that said, there still are some open choices out there, as well as the SPDR Barclays Capital Convertible Bond ETF (NYSEArca: CWB)

The Bottom Line

When it comes to bonds, most investors focus strictly on Treasuries and investment grade corporates. However, there are plenty of other bond varieties to choose from. And it pays to think outside the box. The previous four varieties are just some of the many types of weird and esoteric bonds out there.

If you’ve enjoyed this article, sign up for the free BondFunds.com newsletter.